2025 Factsheets

2024 Factsheets

2023 Factsheets

2022 Factsheets

2021 Factsheets

2020 Factsheets

2019 Factsheets

April 2019 Factsheet

March 2019 Factsheet

February 2019 Factsheet

January 2019 Factsheet

2018 Factsheets

December 2018 Factsheet

November 2018 Factsheet

October 2018 Factsheet

September 2018 Factsheet

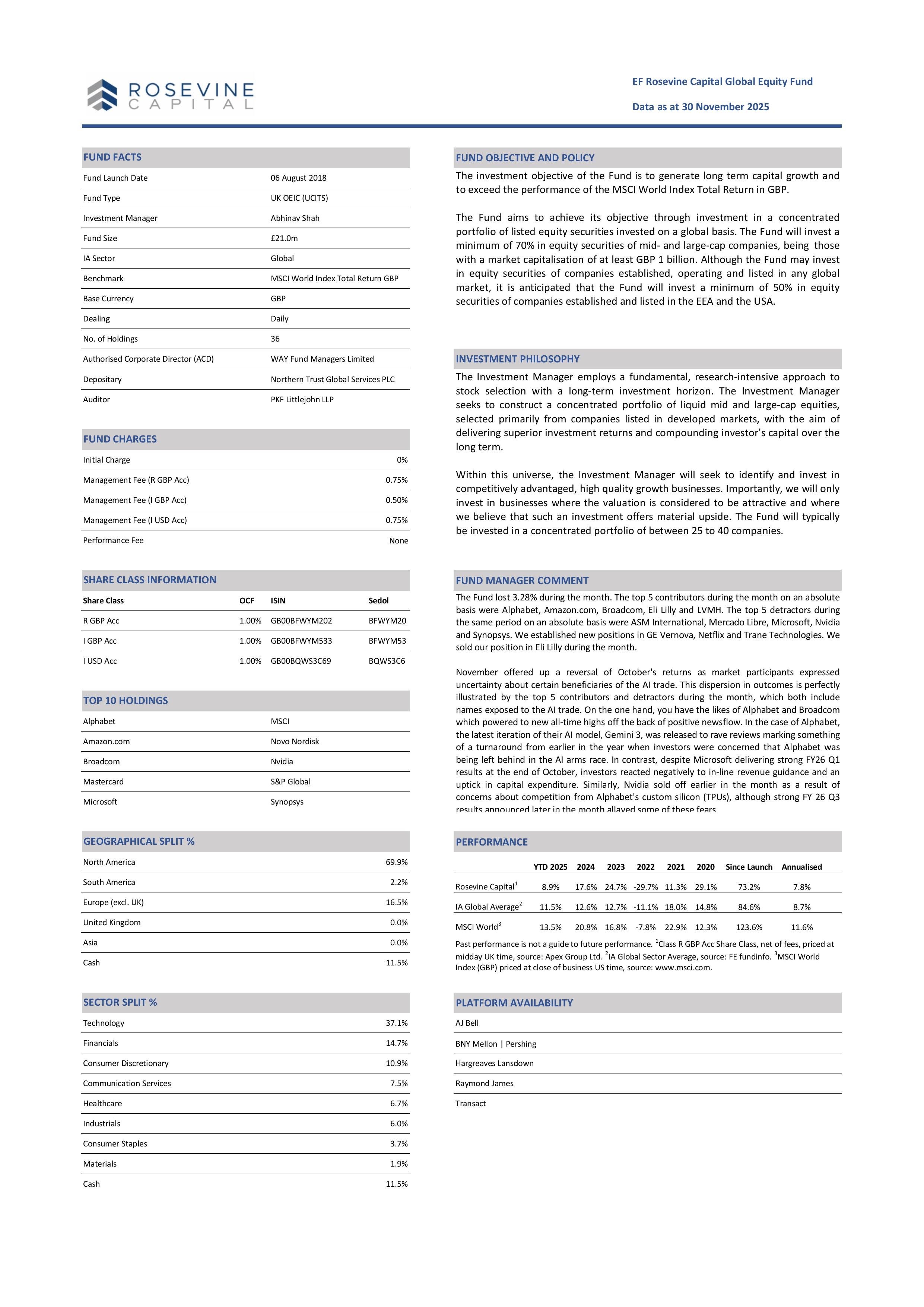

| undefined | |

|---|---|

| Fund Launch Date | 6th August 2018 |

| Fund Type | UK OEIC (UCITS) |

| IA Sector | Global |

| Base Currency | Sterling |

| Benchmark | MSCI World Index Total Return GBP |

| Share Classes | GBP R Acc: GB00BFWYM202 |

| GBP I Acc: GB00BFWYM533 | |

| USD I Acc: GB00BQWS3C69 | |

| Management Fee | GBP R Acc - 0.75% per annum |

| GBP I Acc - 0.50% per annum | |

| USD I Acc - 0.75% per annum | |

| Performance Fee | No |

| Dealing | Daily |

| Authorised Corporate Director (ACD) | WAY Fund Managers Limited |

| Depositary | Northern Trust Global Services PLC |

| Auditors | PKF Littlejohn LLP |

Before investing, please make sure you have read the UCITS Key Investor Information Document for the EF Rosevine Capital Global Equity Fund – Class I (GBP Acc), Class I (USD Acc) and Class R (GBP Acc). If you are unsure as to the suitability of an investment for your circumstances, please seek independent financial advice. Please note that investments can go down in value as well as up.

You can invest in the fund directly through WAY Fund Managers Limited by calling the following number: 01202 855856.

Application Forms

Fund Literature

Fund Charges